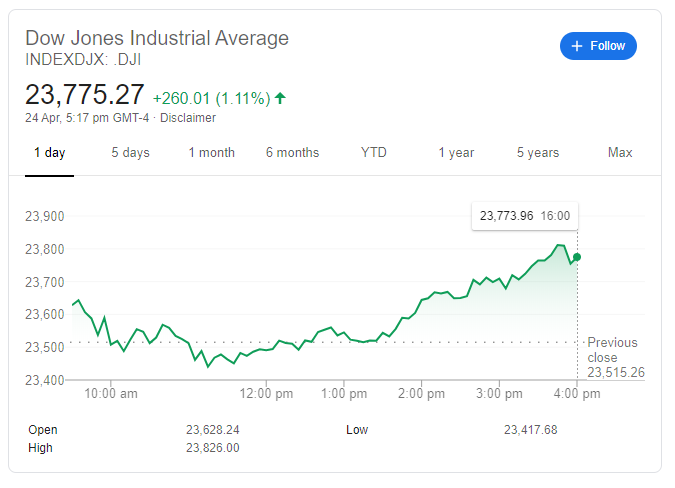

DJIA or Dow Jones Industrial Average referred to as “Dow Jones” is the popular and widely-known stock market indexdjx:.dji. This measures daily stock market actions of 30 US-traded companies that are listed on the NY Stock Exchange. These thirty publicly-owned firms are considered to be the leaders in the US economy. Dow Jones is the stock indices made by Dow and Jones Company founder & Wall Street editor Charles Dow. However, when you look a bit closely, increase in the volatility has actually led to the strange set of the divergences in major indexes. Whereas I generally do not follow Dow Jones IA (INDEXDJX:.DJI), it’s worthwhile looking today, since it is in a different place than Nasdaq or INDEXNASDAQ:.IXIC. S&P 500 or INDEXSP:.INX, in the meantime, is somewhere in a middle.

When DJIA was launched in the year 1896, this included just 12 companies in the US that were engaged in industrial activities. Over the past few years, the index changed all along with its economy, and composition includes companies in many other sectors like health, technology, and retail. Index changes when some components experience any financial distress, which renders it the less important company in its sector when there’s a significant shift in an economy that has to get reflected in composition.

Also Read: What Is Master Data Management and Why Do You Need It?

Dow Jones Average (INDEXDJX:.DJI) is the stock market index, which tracks down stock costs of the top 30 US firms. Analysts use this to gauge the health of the stock market and reflect the investors’ confidence in such companies and in the overall economy.

Components of Dow Jones Average

There aren’t any specific rules for the company to include in thirty company stocks in a DJIA. But, for the company to come to DJIA, it should account for the significant part of economic activities in the US. This company should be listed on NASDAQ (INDEXNASDAQ:.IXIC) and be the primary company in the industrial sector. DJIA makes many changes to the components to reflect several changes in an economy. The current changes happened to include:

- July 2018, the Wallgreens Boots Alliance Had to Replace the General Electric

- In September 2017, Dow Du Pont replaced DuPont. And following the merger of the Dow Chemical Company & DuPont

- In March 2015, Apple Company replaced AT&T

How Does DJIA Work?

DJIA was made to measure the movements of some leading companies in the US that were engaged in industrial activities. This uses a price-weighted index, it means that the stocks with the higher share cost carry the higher weight in an index than the stocks with the low share cost. Initially, Dow calculated an average just by adding stock rates of 12 companies as well as dividing by 12. Then, the calculation of an index was changed for reflecting relative importance of every component-based over what percentage of the index’s total value that it represents.

DJIA is the price-weighted index, where the cost of 30 stocks in the index is been added together and divided by the divisor, called Dow Divisor. This Divisor is there for counteracting an effect of some structural changes like stock splits. Dow Divisor is around 0.14748071991788.

Criticisms of DJIA

Even though the Dow Jones Industrial Average is the highly important stock market movement tracker, and there are a few shortcomings that are associated with an index. With more than 5,300 stocks traded on NASDAQ & NYSE, the Dow Jones Industrial Average INDEXSP:.INX isn’t the best indicator on how an overall market is doing as it includes just 30 stocks. Below 1 percent representation of the total stock market might be misleading as well as might not portray an actual state of the economy.

Also, the use of the price-weighted index when opposed to the market-weighted index provides the benefit to certain DJIA components over some others. For instance, the component with a share rate of around $120 will exert more than 4 times influence on a DJIA than the company with the stock cost of $30 although a $30 stock company might be very important to the economy. Thus, the professional fund managers make use of alternative indices like the S&P 500 Index for monitoring the overall performance of the stock market.

Also Read: Lyle Advisors Shares Capital Raising Tips for Small Businesses

Conclusion

It is the problem because all names are vulnerable to short-term pullbacks than usual. Suppose they trim gains, they will do certain damage to the index itself, and the gauge is vulnerable to certain profit-taking.

Leave a Reply